Trying to Choose The Right Loan? Stop Looking at Just The Rates!

It is not uncommon for investors to be presented with different loan options when they are securing a loan for a property. Often these options can differ in the required loan to value (LTV), the interest rate or whether or not they allow you to roll in construction costs. I am probably presented options by investors every few weeks that are not sure how to compare the loan options, and it is not uncommon for the banker to falter when asked what the incremental costs is of the additional money. (In fact I may be cheating a little by writing this since I can then reference it to inquiring purchasers at a later date).

How to Start Building Wealth With Real Estate

Our step-by-step guide to “the stack” shows how you can go from zero to real estate hero—and make your first million.

Let’s Look at an Example

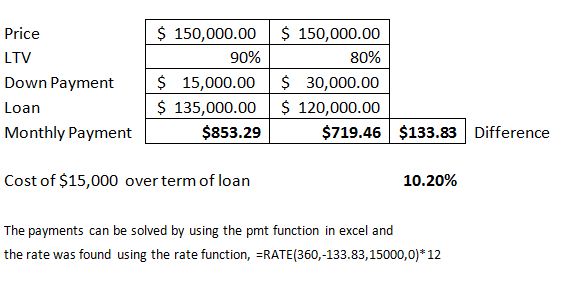

In this example you can purchase a property valued at $150,000. To simplify the example let’s assume both are offered with equal terms, 30 years. The first loan option will allow you an LTV of 90% at a rate of 6.5% while the second calls for an LTV of 80% at 6%.

The theoretical caller always calls and presents the above option as a great way to get “cheap” funding. They look at the difference on the rate and are pleased with a .5% interest rate difference that allows them to preserve $15,000! The problem is that the actual cost for this is much greater. To complete the example above you are actually borrowing the $15,000 at a rate of 10.20%. This is found by looking at the difference in payments. Below is my attempt to simplify the process.

In practice this means that you borrow the additional funds at 10.20% only IF it is the cheapest option available to you. If you are borrowing just to borrow or because you like having a sizeable cushion in cash you may want to give this a second thought. Is it worth it to keep your savings earning less than 1% to borrow at 10.20%? If instead you are convinced that you can have that extra money work for you and EARN a rate of return greater than 10.20% then this is a great route to go. There is no “right” answer but the cost of the additional $15,000 is rather high even though it seems misleadingly low at .5%. This argument will generally hold since rates are often higher the more you borrow.

In practice this means that you borrow the additional funds at 10.20% only IF it is the cheapest option available to you. If you are borrowing just to borrow or because you like having a sizeable cushion in cash you may want to give this a second thought. Is it worth it to keep your savings earning less than 1% to borrow at 10.20%? If instead you are convinced that you can have that extra money work for you and EARN a rate of return greater than 10.20% then this is a great route to go. There is no “right” answer but the cost of the additional $15,000 is rather high even though it seems misleadingly low at .5%. This argument will generally hold since rates are often higher the more you borrow.

Last week I actually had someone come to me with a similar question. They were trying to determine whether it would be wise to purchase a $100,000 property using a conventional loan which required 25% down payment at a rate of 5% or a homestyle loan that required 20% at a rate of 5.5%. What was unique about this option was that the homestyle option allowed this investor to roll in about $20,000 worth of renovation costs. This changes our calculations a little and is one of the few times it may actually be OK to roll the cost in.

Related: For Real Estate Investors, Finding Good Loans Is Tougher Than Finding Good Deals

This above means that the cost to borrow these funds is 4.52%. If you have money sitting in a cash account earning 1% this may still not be the best option. However, the prospect of this type of program certainly must be considered. Some investors may even argue that borrowing money at this rate is nearly free money when inflation is taken into account.

Related: Investment Property Loans: The Ultimate Guide

Still Reluctant?

For those of you who have your own team of workers that work “under the radar” you may still be reluctant to do even this deal with the cost to borrow at 4.52%. The reason is when funds are supplied by a third party your team must be licensed by the state and the particular city. This may result in you not being able to use your team which would drive the cost on projects up 10-20% more than what you can do “under the radar”. In other words when using your own funds and team you may get the $20,000 job done for $16 – 18,000. This is money saved today which completely skews the results in FAVOR of doing the deal with your own funds. Depending on where you are this may not be an option. However, the conclusion to draw here is that understanding financing and financing costs are more than just comparing rates.

While I didn’t look at it here we could also compare different loan terms in the same fashion. Believe it or not I compare every loan option presented to me for parcels in my own portfolio a similar way until I find the maximum I should borrow for any one given property given my next best use of the funds. I hope this will at least get you thinking about incremental cost and how it impacts your purchase.

…what are your thoughts?

Sorry, the comment form is closed at this time.